Shanghai/New York: Temu, the global discount e-commerce platform owned by China’s PDD Holdings, saw its daily user base in the United States plummet by 58% in May, according to data from market intelligence firm Sensor Tower. The sharp decline follows the U.S. government’s termination of the “de minimis” exemption—a policy that had allowed low-value shipments from overseas to enter the country without incurring tariffs.

The White House ended the loophole on May 2, aiming to level the playing field amid rising trade tensions with China. The change prompted Temu to significantly reduce its advertising budget in the U.S. and revamp its order fulfillment strategy to adapt to the new economic environment.

For years, Temu and fellow Chinese e-commerce giant Shein had leveraged the de minimis provision to ship goods directly from suppliers in China to American consumers, thereby keeping costs down. With that advantage gone, both companies have faced challenges, but Temu has been hit especially hard.

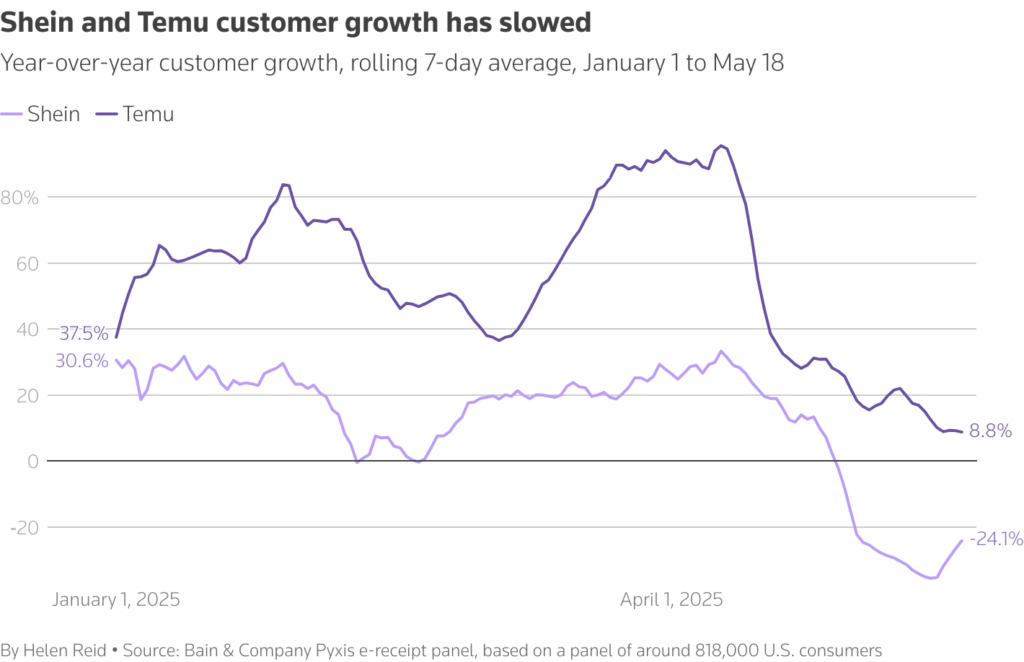

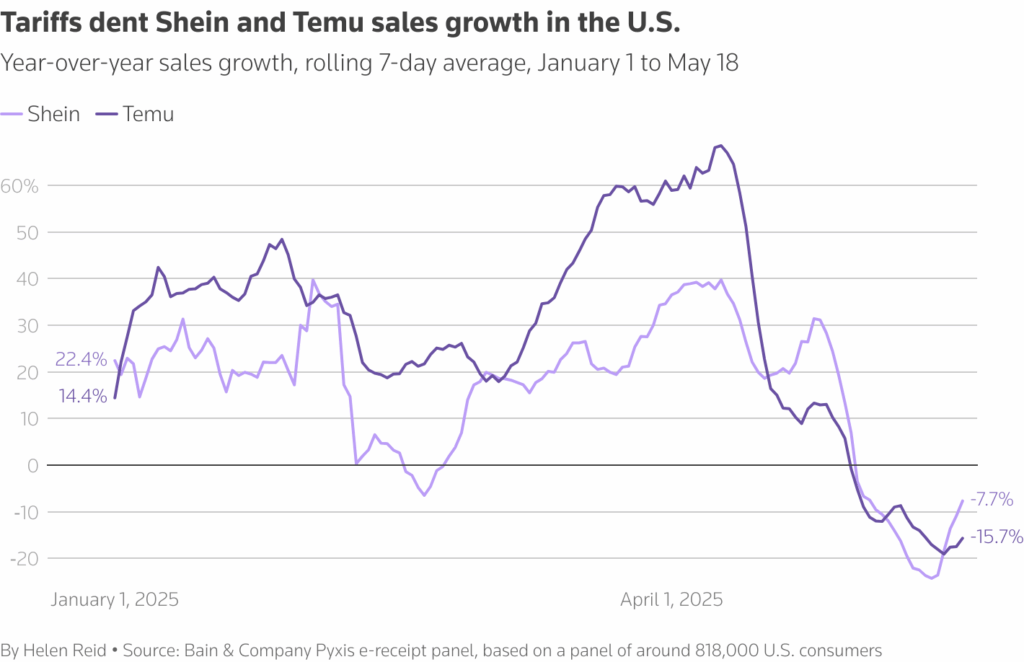

While Shein has managed to maintain consumer spending and even increase average order values, Temu has struggled to recover. Consultancy Bain & Company reported that Temu’s customer growth and sales metrics have declined more sharply than Shein’s since the implementation of the tariffs initiated during Donald Trump’s presidency.

Temu declined to comment on its shrinking U.S. user base or how it plans to navigate the increasingly hostile trade environment.

“Engagement on Temu has dropped significantly following the end of the exemption,” said Morgan Stanley equity analyst Simeon Gutman in a May research note. “While the tariff environment is uncertain, if the status quo remains for an extended period, we believe Temu’s competitive threat will continue to weaken.”

Also Read | Trump Administration Warns Tariff Ruling Could Harm U.S. Negotiations

Last week, PDD Holdings reported first-quarter earnings that missed growth estimates, with executives attributing part of the underperformance to mounting tariff pressure on its sellers. On the post-earnings call, leadership reiterated Temu’s pledge to maintain stable pricing while shifting toward a regional fulfillment model.

Previously, Temu operated a centralized system in which merchants handled supply, and Temu took care of logistics, pricing, and marketing from China. Under the new approach, merchants are expected to ship goods from China to U.S.-based Temu-partnered warehouses, taking on the burden of tariffs, customs documentation, and compliance.

Also Read | Major US Airlines Push Back Against Credit Card Fee Reform, Citing Threat to Reward Programs

“Merchants can ship individual orders from China to Temu-partnered U.S. warehouses, but they would need to address tariffs and customs charges and paper work,” HSBC analysts noted in a recent memo. Temu, meanwhile, continues to manage local fulfillment, pricing, and its online platform.

Despite its declining presence in the U.S., Temu has found new momentum abroad. According to HSBC, non-U.S. markets now account for 90% of Temu’s 405 million global monthly active users in the second quarter. The company has seen particularly strong user growth in less affluent international markets.