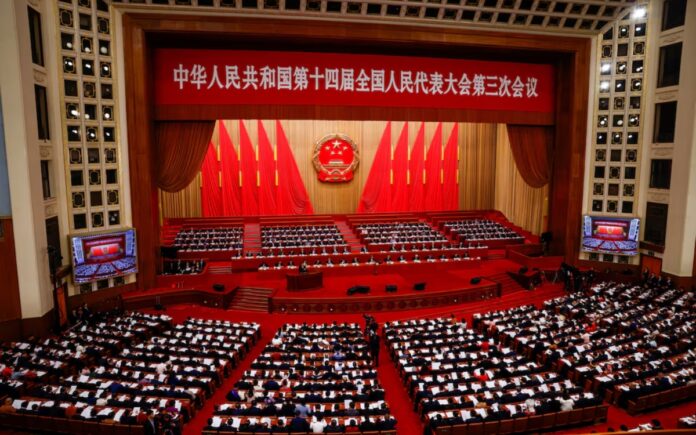

Beijing: China has reaffirmed its annual economic growth target at approximately 5%, allocating increased fiscal resources to offset the impact of rising U.S. trade tariffs and global economic shifts. Premier Li Qiang, addressing the National People’s Congress (NPC), highlighted external challenges, stating, “Changes unseen in a century are unfolding across the world at a faster pace.”

Li acknowledged that an increasingly complex global environment could pose risks to China’s trade, science, and technology sectors. The ongoing trade dispute with U.S. President Donald Trump’s administration threatens China’s industrial sector, further compounded by weak consumer demand and a struggling real estate market.

Trump’s tariff threats extend beyond China, targeting multiple nations, including key U.S. allies, disrupting a global trade system that China has long relied upon. Amid these challenges, Chinese policymakers are under growing pressure to stimulate domestic consumption and reduce dependence on exports and investment-driven growth.

Alex Loo, FX and macro strategist at TD Securities, remarked, “The 5% growth target seems like a tall task for policymakers given the domestic challenges and external trade headwinds.”

Beijing’s Economic Strategy

In response, China is implementing a range of economic measures, including:

- A 4% budget deficit target for 2025, up from 3% in 2024.

- A special action plan to boost consumption.

- The issuance of 1.3 trillion yuan ($179 billion) in ultra-long special treasury bonds, surpassing last year’s 1 trillion yuan.

- A 300 billion yuan allocation for expanded consumer subsidies on electric vehicles, appliances, and other goods.

Economists have urged Beijing to undertake deeper structural reforms, addressing taxation, land policies, and the financial system to strengthen social safety nets and encourage household spending. Currently, household consumption accounts for less than 40% of China’s GDP—20 percentage points below the global average—while investment remains disproportionately high.

Li pledged to close the gap between supply and consumption, improve local government revenue models, and shift incentives towards fostering domestic demand, though no specific timeline was provided.

Also Read | Chinese Premier: ‘Reunification’ with Taiwan Will Be Firmly Pursued

Additionally, local governments will be permitted to issue 4.4 trillion yuan in special debt, up from 3.9 trillion, while Beijing plans to inject 500 billion yuan into major state banks.

Charu Chanana, chief investment strategist at Saxo in Singapore, noted, “It doesn’t look like China wants to go overboard with spending right away given the tariff threats, as they potentially want to save ammunition for later in the year.”

China’s Innovation Push

Despite achieving its 5% growth target last year—partly through late-year stimulus—the benefits have not been widely felt among ordinary Chinese citizens. Concerns over job stability persist as businesses continue to cut costs to remain competitive in global markets.

Chinese manufacturers, faced with declining domestic demand and heightened U.S. trade barriers, are seeking alternative export destinations. However, fears are mounting that this shift will trigger price wars, erode profit margins, and prompt new protectionist measures in emerging markets.

Also Read | GOP Lawmakers Advised to Ditch Town Halls as Protests Escalate

Since taking office, Trump has raised tariffs on Chinese imports by an additional 20 percentage points, with the latest 10-point hike taking effect on Tuesday. “We worry that they will add another 10% and then another 10%,” said Dave Fong, a manufacturer of school bags, electronics, and consumer goods. “That’s a big problem.”

In response, China has announced retaliatory measures against the new U.S. tariffs.

Since the pandemic, Beijing has prioritized investment in “new productive forces”—focusing on high-tech industries and advanced manufacturing—rather than relying solely on consumer-driven growth. Li reaffirmed China’s commitment to supporting high-tech industries and improving investment efficiency as part of its long-term economic strategy.