India’s recent decision to ease tax burdens for the middle class might not significantly stimulate economic growth, according to Moody’s Ratings. This assessment comes in the wake of the government’s budget presentation on Saturday, where Moody’s maintained its growth forecast for India at 6.6% for the next fiscal year.

Christian de Guzman, Senior Vice President and Lead Sovereign Analyst for India at Moody’s, expressed uncertainty about the growth impact of these tax measures. “It remains unclear whether the Indian government has done enough to boost economic growth,” Guzman stated. He emphasized that the effectiveness of these tax cuts largely hinges on whether consumers will utilize the additional disposable income for spending.

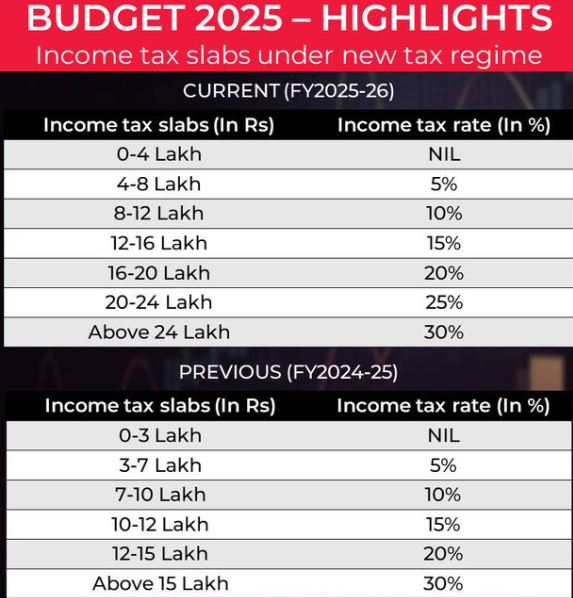

The budget introduced by the Indian government increased the tax exemption limit to 1.28 million rupees ($14,800) annually from 700,000 rupees, alongside reducing tax rates for higher income brackets.

Also Read: India’s 2025/26 Budget Focuses on Agriculture, Manufacturing, and Economic Growth

However, Guzman highlighted that investments in infrastructure through capital expenditure could offer a more sustained boost to the economy than immediate tax relief. “Capital expenditure for infrastructure development provides a ‘long-lasting’ effect on growth compared with tax cuts,” he noted.

Despite ongoing efforts to reduce the fiscal deficit, Guzman pointed out that the progress in lowering debt metrics is not substantial enough to alter Moody’s current rating perspective on India. In August 2023, Moody’s had confirmed India’s ‘Baa3’ rating, the lowest investment grade, with a stable outlook.

A rating upgrade could lead to lower borrowing costs, increased foreign investment, and greater economic credibility for India. Yet, Guzman warned that the path to fiscal consolidation largely depends on increasing revenue generation alongside expenditure cuts.

The Indian government has set an ambitious target to reduce its debt-to-GDP ratio to around 50% by March 2031. However, Guzman believes this goal might be challenging to achieve without a significant boost in revenue generation.

Key Points

Tax Relief Impact: Moody’s Ratings suggests that India’s tax relief measures for middle-class consumers might not significantly boost economic growth.

Growth Forecast: Moody’s retains India’s growth forecast at 6.6% for the next fiscal year despite the tax changes.

Uncertainty: There’s uncertainty about whether consumers will spend the money saved from tax cuts, impacting the effectiveness of these measures.

Tax Changes: The budget raised the tax exemption limit to 1.28 million rupees from 700,000 rupees, with reduced rates for income above this new threshold.

Capital vs. Tax: Capital expenditure on infrastructure is seen as offering longer-lasting growth benefits compared to tax cuts.

Fiscal Deficit: The government’s efforts to reduce the fiscal deficit continue, but the impact on debt metrics is considered narrow.

Moody’s Rating: India holds a ‘Baa3’ rating with a stable outlook, last affirmed in August 2023.

Fiscal Consolidation: Moody’s indicates that fiscal consolidation needs to be supported by increased revenue, not just expenditure cuts.

Debt-to-GDP Target: The Indian government aims to lower the debt-to-GDP ratio to 50% by 2031, a goal Moody’s views as challenging without substantial revenue increases.