Beijing: China’s lithium prices saw a rebound on Friday after a significant earthquake struck Chile’s key lithium-producing region, although ongoing demand concerns continue to impact the metal essential for electric vehicle batteries.

The most-traded November lithium carbonate futures on the Guangzhou Futures Exchange climbed 2.9% to 89,800 yuan ($12,356.89) per metric ton on Friday. This rebound comes after prices had dropped to a seven-month low of 86,450 yuan in the previous session.

Impact of the Chilean Earthquake

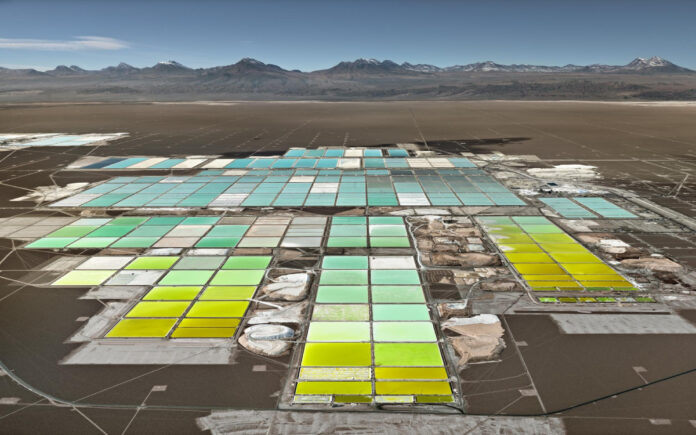

A 7.3-magnitude earthquake struck northern Chile, which holds the world’s largest lithium reserves. Approximately 90% of these reserves are located in the Atacama Desert, close to the earthquake’s epicenter. The earthquake heightened supply fears, as Chile is a major exporter of lithium chemicals to China.

Also Read | What is CrowdStrike’s Role in the Recent Global Tech Outage?

Demand Concerns Amid Political Uncertainty

Investor sentiment was also influenced by speculation about the U.S. presidential election. Bets that Donald Trump might win the upcoming election have added to demand concerns. Trump has promised to reverse many of President Joe Biden’s climate policies, including those supporting electric vehicles. Zhang Yuan, an analyst at CITIC Futures, noted, “A less-EV-favored Trump administration added to demand concerns, given the already much lower-than-expected EV sales in the U.S. and Europe this year.”

In Europe, fully electric and plug-in hybrid vehicle sales fell 7% in June, as reported by market research firm Rho Motion. Conversely, sales in the U.S. and Canada increased by 6%. Macquarie analysts have projected that EV sales growth in China, a major industry driver, will slow from 30.2% last year to 24.6% this year.

Also Read | Russian Court Sentences U.S. Reporter Evan Gershkovich to 16 Years for Espionage

Supply Dynamics and Market Forecast

Surging supplies are also impacting the market. China produced 303,200 tons of lithium carbonate in the first half of the year, a 57.4% increase from the same period last year, according to Mysteel data. Zhang observed, “Better lithium carbonate prices since March encouraged production. However, producers could curb output as recent price falls squeezed their margins. August is likely to see a decline in output.”

Prices had reached an all-time high in November 2022, but the growing surplus has driven them down. CRU’s latest forecast anticipates a global surplus of 90,000 tons of lithium carbonate equivalent for this year. In response to falling lithium product prices, Chinese producers Ganfeng Lithium and Tianqi Lithium have warned of potential losses for the first half of this year.