Hong Kong: Chinese electric vehicle battery giant Contemporary Amperex Technology Co. Limited (CATL) is set to raise at least HK$31.01 billion (approximately $3.99 billion) through its highly anticipated Hong Kong listing, according to a prospectus filed on Monday. If successful, the listing would become the largest global public offering of 2025 so far.

According to the filing with the Hong Kong Stock Exchange, CATL plans to sell 117.9 million shares at a maximum offer price of HK$263 per share. The deal size could rise to as much as $5.3 billion if both the offer size adjustment and greenshoe options are fully exercised.

The company’s shares in Shenzhen surged 3.6% following the announcement, reaching a six-week high and outperforming China’s blue-chip CSI300 index, which rose by 0.9%.

CATL’s listing would surpass Japan’s JX Advanced Metals’ $3 billion IPO in March, making it the world’s largest offering this year to date, according to Dealogic data. In Hong Kong, it would mark the biggest equity raise since Midea Group secured $4.6 billion in 2024.

The offering has already attracted significant institutional interest, with more than 20 cornerstone investors—including Sinopec and the Kuwait Investment Authority—committing to purchase approximately $2.62 billion worth of shares. Two sources with direct knowledge of the matter said the institutional tranche of 109.1 million shares is already fully subscribed, though they declined to be named due to the sensitive nature of the information.

CATL has not publicly commented on the demand. The final pricing is expected between Tuesday and Friday, with a definitive price to be announced no later than May 19. Trading is scheduled to begin on May 20.

Retail investors in Hong Kong will have access to 8.8 million shares, the prospectus stated.

Also Read | BLA Urges India to Act, Offers Support in Offensive Against Pakistan

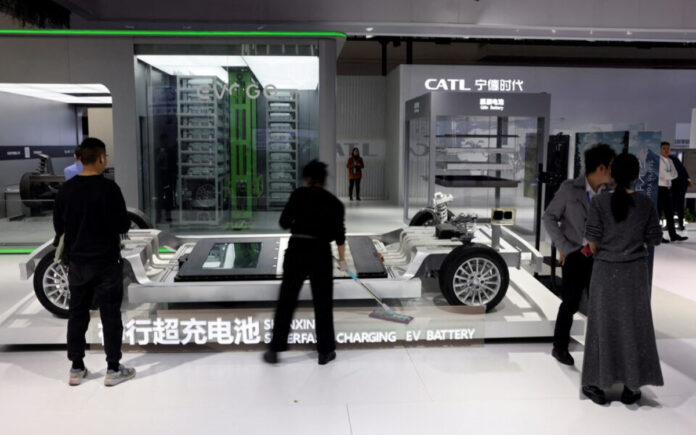

Approximately 90% of the anticipated proceeds—around HK$27.6 billion—will be directed toward CATL’s flagship European project: the construction of a battery manufacturing facility in Hungary. The first phase of the plant, which is backed by a €2.7 billion ($3.03 billion) investment, is set to begin production this year, while the second phase is expected to break ground before year’s end. The plant will serve prominent automakers including BMW, Stellantis, and Volkswagen.

If priced at the upper limit of HK$263 per share, CATL’s Hong Kong stock will be issued at a slight discount compared to its Shenzhen shares’ Friday closing price. A waiver granted by the Hong Kong Stock Exchange allows the company not to publish a minimum pricing threshold, avoiding potential disruption to its Shenzhen-listed shares.

U.S. Trade Restrictions and Market Impact

Notably, U.S.-based onshore investors are excluded from purchasing shares in the Hong Kong offering, although offshore branches of these funds may still participate.

In January, the U.S. Department of Defense added CATL to a list of Chinese companies allegedly linked to China’s military. Addressing the designation, CATL stated in its prospectus: “It does not restrict us from conducting business with entities other than a small number of U.S. governmental authorities, thus is expected to have no substantial adverse impact on our business.”

Also Read | Kurdish PKK Announces End to 40-Year Conflict with Turkish State

CATL added that it is actively engaging with U.S. authorities to challenge what it describes as a “false designation”.

The listing comes amid ongoing U.S.-China trade tensions. While officials from both countries held what they described as constructive talks in Geneva over the weekend, punitive tariffs remain in effect—145% on Chinese goods by the U.S., and 125% on American imports by China.

“Tariff policies have been rapidly evolving. Currently, we cannot accurately assess the potential impact of such policies on our business, and we will closely monitor the relevant situation,” the company noted in its filing.