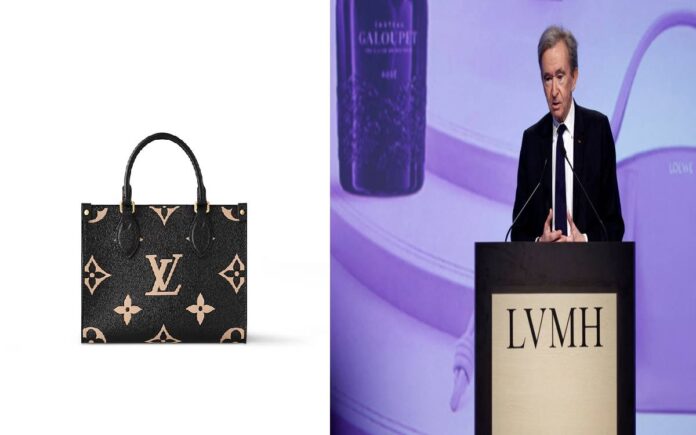

Austin: When LVMH CEO Bernard Arnault and then-President Donald Trump inaugurated a Louis Vuitton factory in rural Texas in 2019, it marked a bold step in the French luxury giant’s expansion into U.S. manufacturing. But six years later, the vision of crafting high-end handbags in America has been marred by persistent problems—ranging from workforce challenges to quality control issues—at the brand’s Alvarado facility.

According to 11 former employees, the factory has consistently ranked among the worst-performing Louis Vuitton production sites globally. A senior industry insider and multiple ex-workers cited internal rankings showing the Texas plant “significantly” underperformed compared to Louis Vuitton’s other ateliers in Europe.

The factory—situated on a sprawling 250-acre ranch and dubbed “Rochambeau” after a French general who fought in the American Revolutionary War—was intended as a strategic move to sidestep potential tariffs on European-made luxury goods. However, since its inception, it has been plagued by a lack of skilled artisans, high waste rates, and intense pressure on workers to meet production goals.

“The ramp-up was harder than we thought it would be, that’s true”, admitted Ludovic Pauchard, Louis Vuitton’s industrial director, in response to Reuters’ detailed findings.

Struggles on the Production Floor

Three former employees noted the site had trouble finding leatherworkers who could meet the stringent standards synonymous with Louis Vuitton. One insider said it took years for the factory to successfully produce even the basic interior pockets of the iconic Neverfull tote. Mistakes in the cutting and assembly process reportedly led to waste rates of up to 40%—double the industry average.

Several workers described a high-pressure environment where supervisors allegedly turned a blind eye—or in some cases encouraged—methods to conceal defects. Techniques included melting canvas and leather to hide stitching errors or holes.

Pauchard acknowledged these past issues, attributing them to a single manager no longer with the company. “This dates back to 2018 and one particular manager who isn’t part of the company anymore”, he said.

Louis Vuitton insists quality remains uncompromised. “Any bag that goes out of it must be a Louis Vuitton bag. We make sure it meets exactly the same quality”, Pauchard added.

Yet, poorly made bags deemed unsellable are shredded and incinerated on-site, according to two former employees familiar with the supply chain.

Limited Product Scope, Modest Wages

The Texas site primarily handles simpler bag models like the Felice pochette, Metis, and Carryall. More sophisticated designs are still crafted in European facilities. Employees were initially paid around $13 per hour, with wages increasing to about $17 by 2024—still modest compared to the luxury prices of the products they assemble, which retail between $1,500 and $3,000.

A former leatherworker, a migrant proud to join the prestigious brand, recalled intense pressure to meet daily targets. Others echoed similar sentiments, noting that some employees cut corners due to the strain.

Damien Verbrigghe, Louis Vuitton’s international manufacturing director, emphasized that rigorous quality demands naturally led some workers to seek roles in other fields. “Some people chose to leave us because it’s a job that requires a lot of savoir faire”, he said.

A Costly Investment with Growing Pains

Despite operational setbacks, LVMH has invested heavily in its Texas operations. The first factory cost an estimated $30 million, with a second workshop completed in 2023 at a cost of $23.5 million. Tax incentives played a significant role—LVMH secured a 10-year, 75% property tax break from Johnson County, worth an estimated $29 million.

Initial job projections were lofty: Arnault pledged to create 1,000 high-skilled roles. As of early 2025, the workforce remains under 300—a figure confirmed by Verbrigghe. Recruitment difficulties, the COVID-19 pandemic, and declining local demand have all hindered growth.

Shifting West Coast Operations

LVMH now plans to consolidate its U.S. production footprint by relocating operations from California to Texas. At a town hall last fall, workers in California were informed that their facility would close by 2028. They were offered transfers to Texas or the option to leave. However, the move has yielded limited success, with company leaders acknowledging they underestimated the logistical and cultural distance between California and Texas.

Still, Louis Vuitton remains committed to the Texas plant and is actively transferring artisans and refining training programs to match the standards of its European workshops.

As the company continues to navigate the complexities of luxury craftsmanship in a non-traditional market, its Texas experiment remains a case study in the balance between global branding and local realities.