Berlin, April 5, 2025 — The German government is reportedly considering the withdrawal of its vast gold reserves stored in the United States, amid growing concerns about the potential return of Donald Trump to the White House and the implications his policies may have on international financial stability.

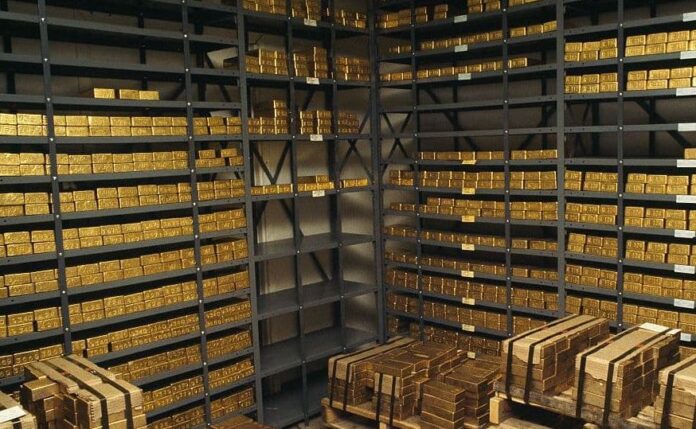

According to sources familiar with the matter, officials in Berlin have initiated high-level discussions over the possibility of repatriating the country’s 1,200-ton gold stockpile currently held at the Federal Reserve Bank of New York. The reserve is valued at approximately $124 billion and represents a significant portion of Germany’s total gold holdings.

Also Read: Gavi Sends Over 1 Million Meningitis Vaccines to Nigeria Amid Outbreak

The move is being considered as a precautionary measure, as fears mount in Europe about the unpredictability of U.S. foreign and economic policy under a possible second Trump administration. Officials are said to be particularly concerned about the former U.S. president’s past criticism of multilateral alliances, central banking systems, and global financial institutions.

While no final decision has been made, the discussions reflect a broader sense of unease among European allies who have been reassessing their financial and strategic dependencies on Washington. Germany previously repatriated a portion of its gold from the U.S. between 2013 and 2017, citing the need to diversify storage and assert more direct control over national assets. However, the current deliberations are understood to be more urgent and politically charged, given the international uncertainty surrounding the upcoming U.S. election.

The Bundesbank, Germany’s central bank, has so far declined to comment on the matter. Meanwhile, U.S. officials have not issued any public response to the reports. If carried out, the withdrawal would mark one of the most significant gold transfers in recent years and could signal a shift in transatlantic economic trust.

Key Points:

- Germany considers gold withdrawal: Berlin is reportedly weighing the repatriation of 1,200 tons of gold, worth approximately $124 billion, currently stored in the U.S.

- Stored at Federal Reserve: The gold reserves are held at the Federal Reserve Bank of New York, representing a major portion of Germany’s national gold holdings.

- Concerns over Trump’s policies: The move is driven by growing concerns about Donald Trump’s potential return to the White House and the unpredictability of his foreign and economic policies.

- Past repatriation history: Germany previously repatriated some of its gold from the U.S. between 2013 and 2017, citing diversification and sovereign control.

- No official decision yet: Discussions are ongoing at high levels within the German government, but no final decision has been announced.

- Potential global impact: A withdrawal of this scale could affect global financial confidence and signal growing transatlantic economic tensions.