Kolkata: HDFC Asset Management Co. Ltd., investment manager to HDFC Mutual Fund (HDFC MF), one of India’s leading mutual fund houses, announces the launch of the HDFC Nifty India Digital Index Fund, a passively managed fund aiming to track the Nifty India Digital Index. The New Fund Offering (NFO) opens on November 22, 2024, and closes on December 6, 2024. This scheme could be suitable for investors seeking to capitalize on India’s trillion-dollar digital opportunity by providing exposure to both India’s domestic E-Commerce, Fintech companies etc., and export-focused IT Services companies.

The HDFC Nifty India Digital Index Fund offers investors comprehensive exposure to India’s digital transformation through a portfolio of 30 stocks from eligible sectors including Software, Telecom, E-Commerce, Fintech, etc. To provide diversified exposure to the Digital theme, sector weights are capped at 50% each and individual stock weights are capped at 7.5% each. As of October 31, 2024, the Nifty India Digital Index had approximately 50% allocation to domestic-focused sectors like E-Commerce and Fintech and approximately 50% allocation to export-focused segments such as Software and IT Enabled Services.

The fund will be managed by Mr. Nirman Morakhia and Mr. Arun Agarwal. Investors can participate with a minimum investment of Rs. 100 during both the NFO period and the continuous offer period, which commences after the scheme reopens for purchase and sale.

Commenting on the launch, Mr. Navneet Munot, Managing Director and Chief Executive Officer, HDFC Asset Management Company Limited, said, “At HDFC Mutual Fund, we continue to expand our range of investment solutions to meet the diverse needs of investors. The HDFC Nifty India Digital Index Fund will allow investors to participate in India’s digital revolution through a single investment solution that combines exposure to both domestic digital innovators and export-focused IT services champions. Our two decades of expertise in Index Solutions position us strongly to deliver this investment opportunity to our investors.”

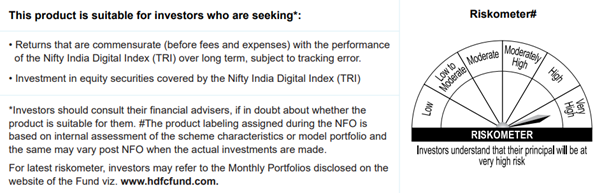

The Scheme being sectoral in nature carries higher risks versus diversified equity mutual funds on account of concentration and sector specific risks.

NIFTY Disclaimer: HDFC Nifty India Digital Index Fund “(the Product)” offered by HDFC Asset Management Company Limited is not sponsored, endorsed, sold or promoted by NSE INDICES LIMITED (formerly known as India Index Services & Products Limited (IISL)). NSE INDICES LIMITED does not make any representation or warranty, express or implied (including warranties of merchantability or fitness for particular purpose or use) and disclaims all liability to the owners of the Products or any member of the public regarding the advisability of investing in securities generally or in the Product linked to Nifty India Digital Index (TRI) or particularly in the ability of the Nifty India Digital Index (TRI) to track general stock market performance in India. Please read the full Disclaimers in relation to Nifty India Digital Index (TRI) in the SID of the Product.

About HDFC AMC

HDFC Asset Management Company Limited (HDFC AMC) is an Investment Manager to HDFC Mutual Fund, one of the largest mutual funds in the country. It was incorporated under the Companies Act, 1956, on 10th December 1999 and was approved to act as an Asset Management Company for HDFC Mutual Fund by SEBI on 3rd July 2000. It has other SEBI licenses viz. PMS / AIF. HDFC AMC manages a diversified asset class mix across Equity and Fixed Income/Others. It also has a countrywide network of branches along with a diversified distribution network comprising Banks, Independent Financial Advisors and National Distributors.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.