Kolkata: Eris Lifesciences Limited, a leading Indian branded formulations manufacturing company, Friday (25th October, 2024) announced its earnings for the second quarter and half year ended of FY25.

Consolidated Financial Highlights

Commenting on the results, Mr. Amit Bakshi, Chairman & Managing Director of Eris Lifesciences Ltd., said, “The acquired businesses of Biocon and Swiss Parenterals have been integrated and are scaling up in line with our expectations. We are on track to achieve our revenue guidance of INR 2,600 crore in Domestic Formulations and INR 3,000 crore on a consolidated basis. We continue building up our capabilities in the Biologics segment. With a strategic investment in Levim Lifetech we will become a vertically integrated Biotech player with capabilities across the value chain starting with Product Development and Bulk Manufacturing all the way through to Dosage Form manufacturing and Marketing. This significantly strengthens our value proposition and business economics in the INR 15,000+ crore Indian Biologics market.”

Q2FY25 and H1FY25 – Financial Highlights

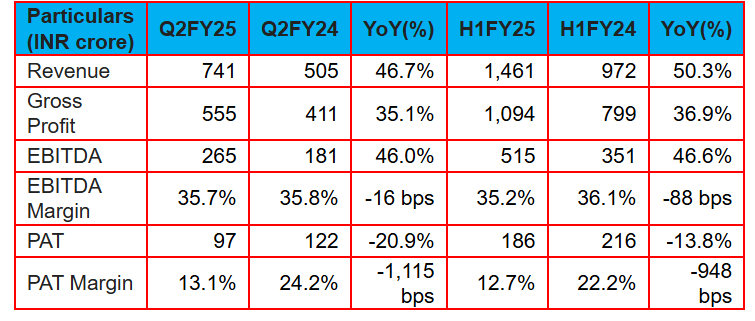

- Revenue of Q2 FY 25 grew by 47% YoY to INR 741 Cr and H1 FY 25 grew by 50% YoY to INR 1,461 Cr

- EBITDA for Q2 FY 25 is INR 265 Cr, with 36% EBITDA margin and H1 FY 25 is INR 515 Cr with 35% EBITDA margin

- PAT for Q2 FY 25 is INR 97 Cr with 13% PAT margin and H1 FY 25 is INR 186 Cr with 13% PAT margin

- Operating Cash flows are 119% of EBITDA in Q2 and 94% of EBITDA in H1

- Net Debt as on 30 Sept is ~INR 2,500 Cr

Q2FY25 – Business Highlights

- Domestic Branded Formulations segment revenue grew by 31% yoy and EBITDA grew by 30%

- Branded Formulations YPM grew to INR 5.7 lakh in Q2 FY25 from INR 5.1 lakh in Q2 FY24; up by 12%

- Q2 growth for Eris is 9.2% vs. IPM growth of 8.1%: Eris is ahead of the market by 104 bps and has shown market-beating growth in 4 out of top 5 therapies (as per AWACS)

- Successfully launched Erly in Sep’24, our Liraglutide brand in GLP-1 segment

- Entered into strategic partnership with Levin Lifetech, strengthening our Biotech play

About Eris Lifesciences Ltd:

Established in 2007, Eris Lifesciences Ltd. is a publicly listed Indian pharma company and ranks among the Top-20 companies in the Indian Pharmaceutical Market. The company has a domestic branded formulations revenue of INR 3,000+ crore p.a. as per AWACS. Since inception, the company has been focused on chronic/ lifestyle therapies and on high-end super-specialist doctors and consulting physicians. 17 years into the business, the company retains its fundamental strengths in terms of a chronic and sub-chronic focused brand portfolio (80% of sales) and high prescription ranks with super-specialists.

Eris has a fully integrated business model with WHO GMP manufacturing facilities in Guwahati and Gujarat that cater to ~ 60% of its revenue and a pan-India distribution network of over 4,000 stockists and 5,00,000+ chemists. Over 6,500+ employees work out of its corporate offices, the field and manufacturing facilities.

Eris’ operating revenue and profits have doubled in the last 5 years. The company has invested over INR 3,500 crore inorganically in the last 2 years and successfully diversified into several new therapies including Dermatology, Insulins, Nephrology, Oncology and Critical Care. The business model continues to be profitable and cash-accretive with an average operating margin of 35% and cash conversion ratio of over 70% over the last 5 years.