Oil prices surged further on Friday amid rising concerns that Israel may target Iranian oil facilities, while global stock markets mostly advanced, buoyed by continued strength in the U.S. economy.

In a robust signal for the U.S. labor market, the economy added 254,000 jobs in September, far exceeding expectations and surpassing August’s revised figures. The unemployment rate also dropped to 4.1 percent, reflecting a stronger-than-anticipated economic performance.

U.S. markets responded positively, with the Dow Jones Industrial Average climbing 0.8 percent, while the S&P 500 and Nasdaq Composite both finished higher. In Europe, London’s FTSE 100 closed flat, but markets in Paris and Frankfurt ended the day with gains.

The upbeat U.S. jobs report helped ease concerns of a weakening labor market but is not expected to alter the Federal Reserve’s course of gradually reducing interest rates. Analysts predict a 25-basis-point rate cut at the Fed’s next meeting in November, rather than the larger 50-point cut that had been previously speculated.

Mahmoud Alkudsi, an analyst at ADSS, noted, “With data significantly stronger than expected, the Fed is likely to continue cutting rates at a slow and steady pace, with a 25-basis-point reduction in November being the most probable outcome.”

The dollar strengthened following the jobs report, with Fawad Razaqzada of City Index stating that the data “put the nail in the coffin for talk” of a more aggressive 50-basis-point cut.

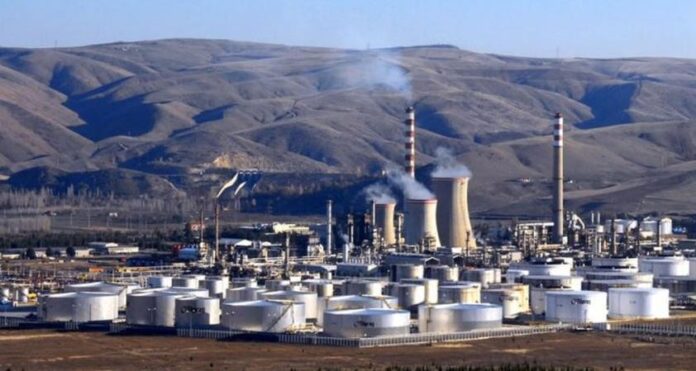

Meanwhile, oil prices extended their gains, rising for the fourth consecutive session. Brent North Sea crude was up 0.6 percent to $78.05 per barrel, while West Texas Intermediate climbed 0.9 percent to $74.38. Concerns over potential Israeli strikes on Iranian oil facilities, following Tehran’s missile attacks on Israel, have fueled the rally. U.S. President Joe Biden indicated that such strikes are under consideration.

However, analysts cautioned that rising geopolitical tensions might not sustain the upward trend in oil prices, as slowing global demand and ample supplies could eventually cap further increases. “Geopolitical risks are in focus, but fundamental oil market drivers suggest that persistently higher prices are unlikely,” said David Oxley, a commodities economist at Capital Economics.

In Asia, Hong Kong’s Hang Seng Index surged nearly 3 percent, continuing a rally fueled by Beijing’s recent economic stimulus measures aimed at reviving growth in the property sector. Mainland Chinese markets remained closed for the Golden Week holiday, while Japan’s Nikkei 225 saw modest gains of 0.2 percent.

In other market news, shares of French video game publisher Ubisoft jumped over 30 percent in Paris after reports suggested that Chinese tech giant Tencent might partner with the company’s founding family for a potential buyout.

Key Market Figures (as of 2055 GMT):

- Brent Crude: UP 0.6% at $78.05 per barrel

- West Texas Intermediate: UP 0.9% at $74.38 per barrel

- Dow Jones Industrial Average: UP 0.8% at 42,352.75 (close)

- S&P 500: UP 0.9% at 5,751.07 (close)

- Nasdaq Composite: UP 1.2% at 18,137.84 (close)

- London FTSE 100: FLAT at 8,280.63 (close)

- Paris CAC 40: UP 0.9% at 7,541.36 (close)

- Frankfurt DAX: UP 0.6% at 19,120.93 (close)

- Hong Kong Hang Seng Index: UP 2.8% at 22,736.87 (close)

- Tokyo Nikkei 225: UP 0.2% at 38,635.62 (close)

- Shanghai Composite: Closed for holiday

Currency Exchange Rates:

- Pound/dollar: FLAT at $1.3124

- Euro/dollar: DOWN at $1.0976

- Euro/pound: DOWN at 83.62 pence

- Dollar/yen: UP at 148.64 yen

4o