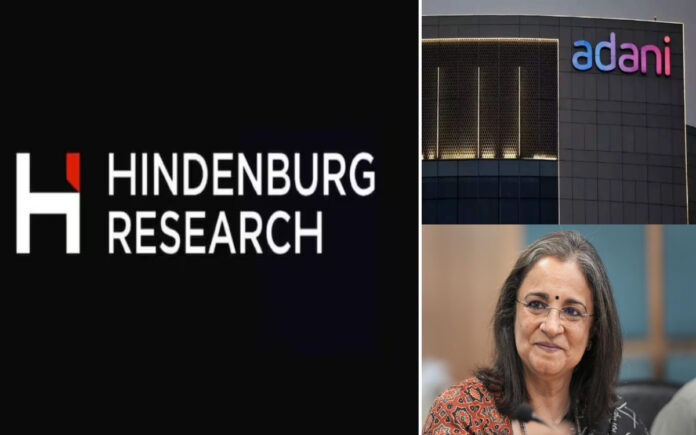

New York/New Delhi: US short-seller Hindenburg Research has launched a new attack on SEBI Chairperson Madhabi Buch, alleging she and her husband had stakes in obscure offshore funds involved in the Adani money siphoning scandal. In a blog post, Hindenburg criticized SEBI’s lack of action, stating, “Eighteen months after our report on Adani, SEBI has shown a surprising lack of interest in Adani’s alleged undisclosed network of Mauritius and offshore shell entities.”

Hindenburg claimed, citing “whistleblower documents”, that “Madhabi Buch, the current chairperson of SEBI, and her husband had stakes in both obscure offshore funds linked to the Adani scandal.”

These funds, based in Bermuda and Mauritius and allegedly controlled by Vinod Adani—the elder brother of Adani Group Chairman Gautam Adani—are accused of being used to round-trip funds and manipulate stock prices. Hindenburg also revealed that “a declaration of funds, signed by a principal at IIFL, states that the source of the investment is ‘salary,’ and the couple’s net worth is estimated at USD 10 million.”

SEBI has yet to respond to these allegations.

In January of the previous year, Hindenburg Research accused the Adani Group of orchestrating “the largest con in corporate history” by using a network of offshore companies to inflate revenue and manipulate stock prices, leading to significant debt accumulation. The report caused a dramatic drop in Adani Group’s market value, erasing over USD 150 billion from the 10 listed entities at their lowest point. Although the group’s shares have since recovered, the allegations remain a point of contention.

Following the Hindenburg report, the Supreme Court directed SEBI to complete its investigation and establish a separate expert panel to examine regulatory lapses. The expert panel did not issue an adverse report on Adani, and the Supreme Court concluded that no further probe beyond SEBI’s investigation was necessary.

Also Read | UK Prime Minister Keir Starmer Cancels Holiday to Address Response to Racist Riots

SEBI, which had been investigating the Adani Group before the Hindenburg report, informed the Supreme Court-appointed panel last year that it was examining 13 opaque offshore entities holding between 14 percent and 20 percent of five publicly traded stocks in the conglomerate. The regulator has not updated whether these investigations have been concluded.

Hindenburg asserted, “The current SEBI Chairperson and her husband, Dhaval Buch, had hidden stakes in the same obscure offshore Bermuda and Mauritius funds used by Vinod Adani.”

The report alleges that on March 22, 2017—just weeks before her appointment as SEBI chairperson—Dhaval Buch sent an email to Mauritius fund administrator Trident Trust regarding their investment in the Global Dynamic Opportunities Fund (GDOF). The email reportedly requested to “be the sole person authorized to operate the Accounts,” suggesting an attempt to move assets out of Madhabi Buch’s name prior to her appointment.

The blog post further claims that a later account statement, dated February 26, 2018, and sent to Madhabi Buch’s private email, detailed the structure of the fund, specifically noting “GDOF Cell 90 (IPEplus Fund 1).” This fund, according to Hindenburg, is the same Mauritius-registered “cell” used by Vinod Adani.