Tokyo: Revised government data released on Monday revealed that Japan’s economy narrowly dodged a technical recession, although the modest expansion in the fourth quarter fell short of expectations, signaling persistent concerns over the sluggish economic recovery.

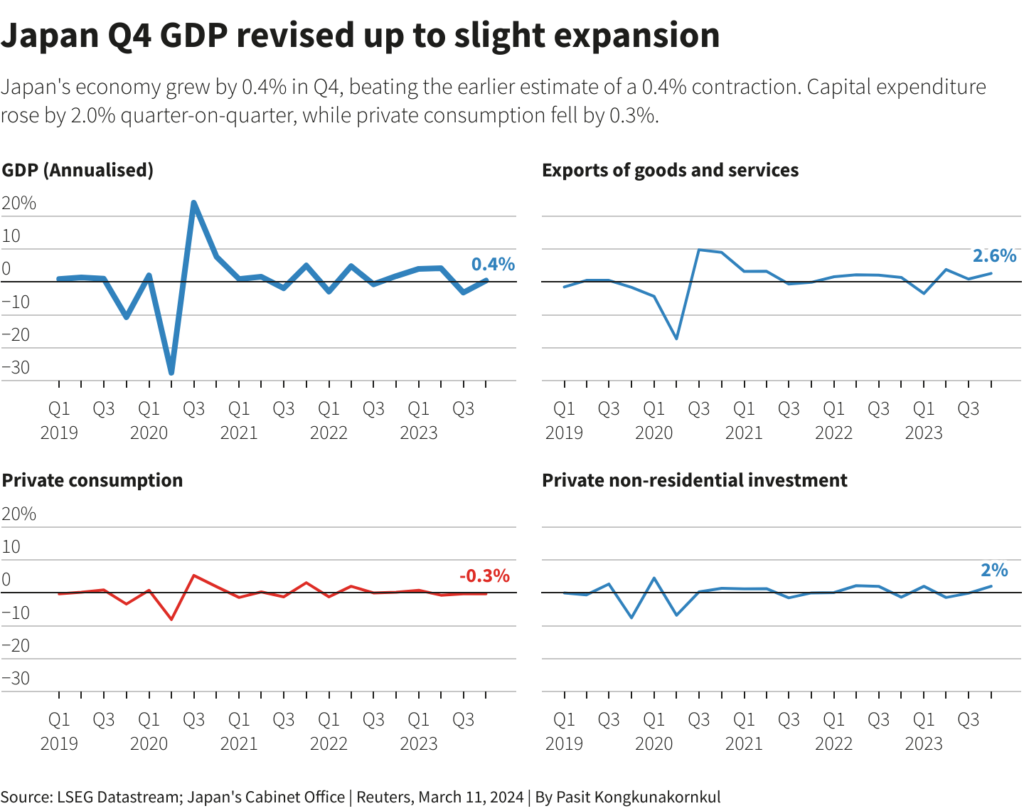

According to the Cabinet Office, Japan’s revised gross domestic product (GDP) expanded at an annualized rate of 0.4% in the October-December period, a notable improvement from the initial estimate of a 0.4% contraction.

However, this figure fell below economists’ median forecast of a 1.1% increase in a Reuters poll. Quarter-on-quarter, GDP registered a growth of 0.1%, in contrast to the initial projection of a 0.1% decline, yet still below the expected 0.3% rise.

Read More: Qantas Pilots Set for Another Strike Amid Ongoing Pay Dispute

Saisuke Sakai, senior economist at Mizuho Research and Technologies, commented, “The headline indicates an upward revision, but domestic demand remains lackluster, particularly in consumption.”

The upward revision coincides with mounting market speculation that the Bank of Japan might abandon its negative interest rates, potentially as early as this month. This speculation has been fueled by recent hawkish remarks from board members, suggesting that Japan is progressing towards the central bank’s 2% inflation target.

The boost in the revision was anchored by a 2.0% quarter-on-quarter increase in capital expenditure, surpassing the preliminary forecast of a 0.1% decline, although it fell short of the median market expectation of a 2.5% rise.

On the other hand, private consumption, constituting approximately 60% of Japan’s economy, experienced a 0.3% decline in the October-December period, slightly worse than the initial estimate of a 0.2% drop. Factors such as seafood and household appliances contributed to the downward pressure in this category, according to a Cabinet Office official.

External demand contributed 0.2 percentage points to real GDP, in line with the preliminary reading.

Looking ahead to the current January-March quarter, Sakai cautioned that the Japanese economy might face contraction due to factors such as a slowdown in the Chinese economy, production halts at a unit of Toyota Motor Corp (7203.T), and weak consumption.

Read More: India Diversifies Defense Procurement Amid Geopolitical Tensions: Shift Away from Russian Arms

Read More: India Proposes Rs 1 Trillion Fund to Boost Indigenous Deep-Tech Adoption

Anticipating BOJ’s Move: Wage Hikes to Drive Policy Shift

Marcel Thieliant, head of Asia-Pacific at Capital Economics, anticipates that despite the data indicating pockets of weakness, the Bank of Japan (BOJ) will likely abandon negative interest rates by next month. This shift is expected due to the growing prospect of significant pay hikes at annual wage talks with labor unions.

“The Bank of Japan tends to prioritize its own consumption activity index and doesn’t appear particularly concerned about recent sluggishness in activity,” stated Thieliant.

The BOJ is scheduled to convene a two-day policy-setting meeting on March 18-19. Japan’s largest trade union confederation, Rengo, has demanded pay rises of 5.85% this year, exceeding 5% for the first time in three decades.

The Japanese central bank has long maintained that robust wage growth is essential for rolling back over a decade of radical monetary policy. In January, Japan witnessed a 22nd consecutive month of inflation-adjusted real wage decline, alongside the largest year-on-year household spending drop in 35 months.