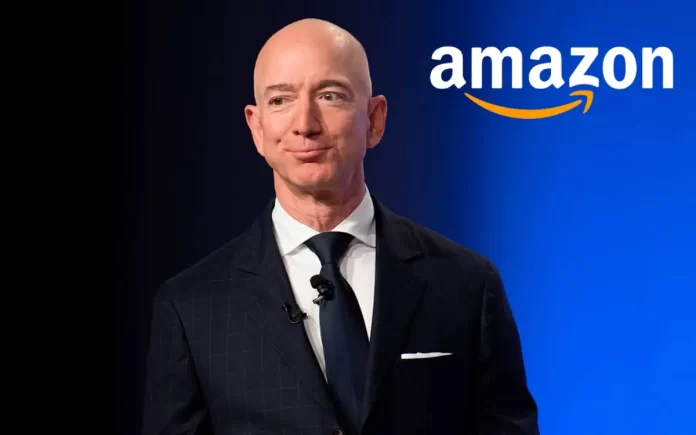

New York: In the latest Jeff Bezos news, the billionaire entrepreneur has unveiled intentions to sell 50 million shares of Amazon, the e-commerce and cloud computing giant, over the next year, as revealed in a company filing on Friday. With a current stock price of $172.13, the estimated value of this divestiture stands at $8.6 billion. This strategic move, initiated on November 8 of the preceding year, is slated for completion by January 31, 2025.

Boosted by the company’s announcement of exceeding holiday sales expectations and the strong early performance of its AI-enhanced offerings in the cloud division, Amazon’s stock witnessed an 8 per cent surge on Friday, according to Reuters.

Great Timing for Share Sale

Jeff Bezos’ decision to sell Amazon shares appears timely. The stock faced challenges in 2022 due to unpredictable shifts in e-commerce demand triggered by the pandemic and global economic instability. In response, current CEO Andy Jassy implemented cost-cutting measures, including significant layoffs reported by CNN, some of which extended into the current year. Despite these challenges, Amazon’s stock has undergone a robust recovery, marking an approximate 90 per cent increase from its low of $84 per share in December 2022.

Potential Tax Strategy: Jeff Bezos’ Florida Move

Jeff Bezos’ recent relocation from Washington state to Florida could strategically allow him to avoid state capital gains taxes on the proceeds from the stock sale. While Washington implemented a capital gains tax last year, Florida does not impose such a tax, as reported by the Seattle Times.

Originating as an online bookstore in 1994, Jeff Bezos transitioned from CEO to executive chairman in 2021. Presently recognized as the third wealthiest individual globally, his fortune is valued at $185 billion, according to the Bloomberg Billionaires Index.